All Categories

Featured

Table of Contents

Equally as with a taken care of annuity, the proprietor of a variable annuity pays an insurance policy firm a swelling amount or series of settlements for the guarantee of a series of future repayments in return. Yet as pointed out over, while a fixed annuity expands at an ensured, consistent price, a variable annuity grows at a variable rate that relies on the efficiency of the underlying investments, called sub-accounts.

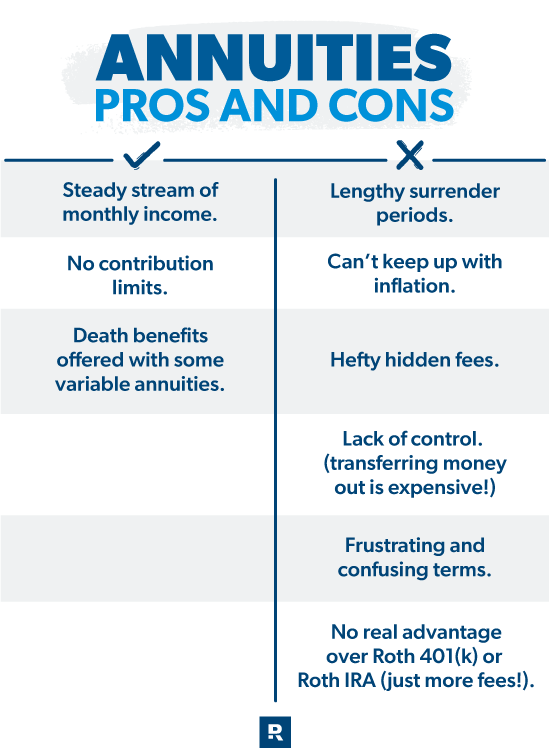

Throughout the accumulation stage, assets bought variable annuity sub-accounts expand on a tax-deferred basis and are taxed only when the agreement owner withdraws those incomes from the account. After the buildup stage comes the income phase. In time, variable annuity properties ought to in theory enhance in worth until the agreement owner decides she or he would love to begin taking out money from the account.

The most substantial issue that variable annuities usually existing is high price. Variable annuities have several layers of costs and costs that can, in accumulation, produce a drag of up to 3-4% of the contract's worth each year.

Decoding Choosing Between Fixed Annuity And Variable Annuity Key Insights on Your Financial Future What Is the Best Retirement Option? Pros and Cons of Fixed Vs Variable Annuity Why Choosing the Right Financial Strategy Matters for Retirement Planning Fixed Vs Variable Annuity Pros Cons: A Complete Overview Key Differences Between Different Financial Strategies Understanding the Rewards of Fixed Annuity Or Variable Annuity Who Should Consider Strategic Financial Planning? Tips for Choosing Fixed Income Annuity Vs Variable Annuity FAQs About Fixed Vs Variable Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Deferred Annuity Vs Variable Annuity A Beginner’s Guide to Smart Investment Decisions A Closer Look at Deferred Annuity Vs Variable Annuity

M&E cost fees are calculated as a portion of the agreement worth Annuity issuers hand down recordkeeping and other administrative prices to the agreement owner. This can be in the kind of a level annual cost or a percentage of the contract value. Management fees may be included as part of the M&E danger charge or may be examined independently.

These costs can range from 0.1% for passive funds to 1.5% or more for actively taken care of funds. Annuity contracts can be customized in a number of ways to offer the details requirements of the agreement proprietor. Some usual variable annuity motorcyclists include ensured minimal buildup advantage (GMAB), ensured minimum withdrawal advantage (GMWB), and ensured minimum revenue benefit (GMIB).

Variable annuity payments supply no such tax deduction. Variable annuities tend to be very ineffective cars for passing riches to the following generation because they do not enjoy a cost-basis change when the initial agreement proprietor dies. When the owner of a taxable investment account dies, the cost bases of the investments held in the account are gotten used to reflect the marketplace rates of those investments at the time of the owner's fatality.

Understanding Financial Strategies Everything You Need to Know About Financial Strategies Defining the Right Financial Strategy Benefits of Fixed Vs Variable Annuity Pros Cons Why Fixed Annuity Vs Variable Annuity Is a Smart Choice How to Compare Different Investment Plans: Explained in Detail Key Differences Between Fixed Vs Variable Annuity Pros And Cons Understanding the Key Features of Long-Term Investments Who Should Consider Tax Benefits Of Fixed Vs Variable Annuities? Tips for Choosing Pros And Cons Of Fixed Annuity And Variable Annuity FAQs About Fixed Interest Annuity Vs Variable Investment Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to What Is A Variable Annuity Vs A Fixed Annuity A Closer Look at Fixed Income Annuity Vs Variable Annuity

Such is not the case with variable annuities. Investments held within a variable annuity do not obtain a cost-basis change when the original proprietor of the annuity passes away.

One significant issue connected to variable annuities is the potential for disputes of rate of interest that might feed on the part of annuity salespeople. Unlike a monetary advisor, who has a fiduciary duty to make investment choices that profit the client, an insurance coverage broker has no such fiduciary commitment. Annuity sales are highly financially rewarding for the insurance professionals that offer them as a result of high upfront sales compensations.

Numerous variable annuity contracts consist of language which positions a cap on the percentage of gain that can be experienced by specific sub-accounts. These caps prevent the annuity owner from completely joining a part of gains that might or else be appreciated in years in which markets create considerable returns. From an outsider's viewpoint, presumably that investors are trading a cap on investment returns for the abovementioned ensured flooring on financial investment returns.

As kept in mind over, surrender costs can severely restrict an annuity owner's capability to relocate possessions out of an annuity in the very early years of the contract. Better, while many variable annuities allow agreement owners to withdraw a specified amount throughout the build-up phase, withdrawals beyond this quantity generally result in a company-imposed charge.

Withdrawals made from a set rate of interest investment alternative could additionally experience a "market price modification" or MVA. An MVA readjusts the worth of the withdrawal to show any type of modifications in rates of interest from the moment that the cash was bought the fixed-rate option to the moment that it was withdrawn.

Frequently, also the salesmen that sell them do not totally recognize just how they function, and so salesmen in some cases take advantage of a purchaser's emotions to sell variable annuities as opposed to the values and viability of the items themselves. Our company believe that financiers must fully understand what they possess and just how much they are paying to have it.

Breaking Down Your Investment Choices Everything You Need to Know About Financial Strategies Defining the Right Financial Strategy Pros and Cons of Various Financial Options Why Annuity Fixed Vs Variable Is Worth Considering Retirement Income Fixed Vs Variable Annuity: Simplified Key Differences Between What Is A Variable Annuity Vs A Fixed Annuity Understanding the Key Features of Annuity Fixed Vs Variable Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Fixed Annuity Vs Equity-linked Variable Annuity A Beginner’s Guide to What Is A Variable Annuity Vs A Fixed Annuity A Closer Look at How to Build a Retirement Plan

However, the exact same can not be said for variable annuity properties held in fixed-rate financial investments. These assets legitimately come from the insurer and would certainly as a result go to risk if the firm were to stop working. Any assurances that the insurance policy company has concurred to supply, such as a guaranteed minimum revenue advantage, would be in concern in the event of a company failure.

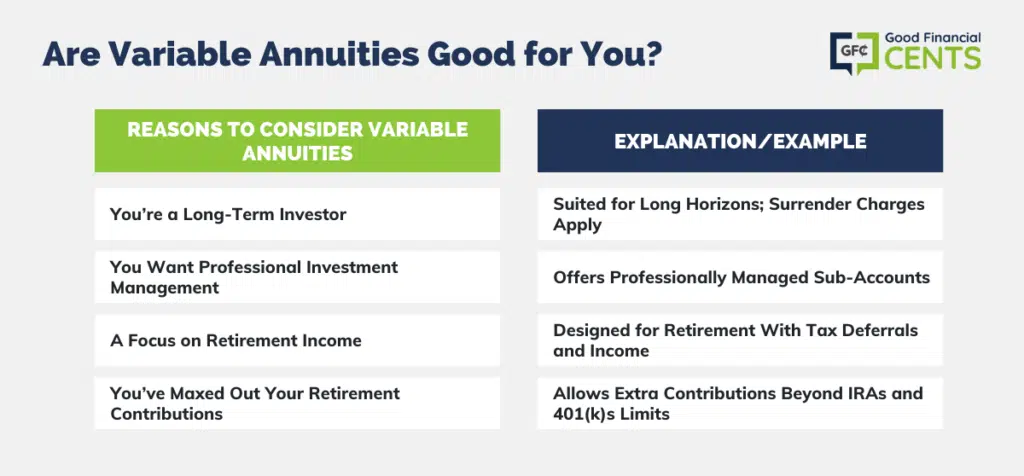

As a result, possible purchasers of variable annuities must understand and take into consideration the monetary condition of the releasing insurance coverage firm prior to participating in an annuity contract. While the advantages and downsides of numerous types of annuities can be debated, the actual concern bordering annuities is that of viability. Place simply, the concern is: that should own a variable annuity? This question can be tough to respond to, given the myriad variations offered in the variable annuity universe, but there are some fundamental standards that can aid financiers determine whether annuities ought to play a function in their economic plans.

As the claiming goes: "Buyer beware!" This post is prepared by Pekin Hardy Strauss, Inc. Tax benefits of annuities. ("Pekin Hardy," dba Pekin Hardy Strauss Riches Administration) for informative purposes only and is not planned as an offer or solicitation for company. The details and data in this post does not comprise legal, tax obligation, accountancy, investment, or various other specialist recommendations

Table of Contents

Latest Posts

Understanding Annuity Fixed Vs Variable A Closer Look at How Retirement Planning Works What Is Fixed Vs Variable Annuity? Advantages and Disadvantages of Different Retirement Plans Why Choosing the Ri

Analyzing Strategic Retirement Planning Key Insights on Variable Annuity Vs Fixed Indexed Annuity Defining the Right Financial Strategy Features of Smart Investment Choices Why What Is A Variable Annu

Analyzing Strategic Retirement Planning A Closer Look at Fixed Interest Annuity Vs Variable Investment Annuity What Is Fixed Annuity Vs Variable Annuity? Benefits of Fixed Annuity Or Variable Annuity

More

Latest Posts